Introduction

Biocartis made its stock exchange debut last week. Debiopharm Diagnostics invested in the company early on, has continued to support Biocartis in subsequent investment rounds, and is proud of the achievements of the Belgian molecular diagnostics company to date.

Facts

Biocartis Group NV raised EUR 100 million ($109 million) with an initial public offering announced on Monday April 27th 2015, and is planning to use the funds to help expand the range of diagnostic tests molecular diagnostic platform tools can perform.

Biocartis listed on the Euronext Brussels exchange under the symbol BCART at an initial price of EUR 11.50, at the high end of the range suggested in its prospectus. The company issued about 8.7 million shares in the offering and has authorized a 15% overallotment. In addition to shares released through the IPO, the company also listed about 30 million existing shares on the exchange.

The market capitalization is around EUR 500 million.

About Biocartis

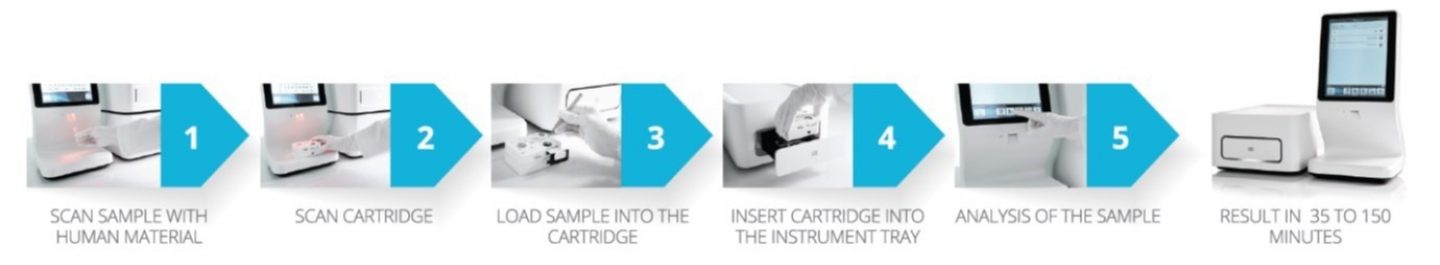

The company’s principal product is the Idylla platform, an automated “sample to result” system for running laboratory tests on a biological sample. It is intended to be a fast and easy solution for laboratory staff and medical professionals to perform molecular analysis in order to diagnose patients or to select and monitor their treatment, in a near patient setting without the need for a molecular biology laboratory or expertise.

The system is capable of performing a wide range of tests, but efforts so far have focused on diagnosing certain types of cancer and infectious diseases. Biocartis hopes to develop four to five new specific diagnostic applications each year, in part using the funds raised through its IPO, according to the prospectus. Current developmental tests include flu, HIV and ebola.

Source: BiocartisThe ease-of-use and efficiency mean that lab tests that used to be outsourced by medical professionals and could take weeks can now be done on site in 30 to 150 minutes.

The Mechelen, Belgium-based company has raised about EUR 233 million since its founding in 2007 prior to the IPO. It currently has developmental partnerships with Johnson & Johnson and Abbott Molecular.

Debiopharm Diagnostics Investment Rationale

Debiopharm Diagnostics is today the 2nd biggest owner of Biocartis. The story began in 2010 with the first investment made during the 2nd financing round. According to Thierry Mauvernay, Delegate of the Board, Debiopharm Group™, the Point of Care strategy envisioned by Biocartis was crucial in the investment decision as well as the track record and quality of its founder, Dr. Rudi Pauwels.

We have to remember that although healthcare expenditures dedicated to diagnostics only represent 2% of the total expenses for healthcare but they influence 60% of treatment decisions. This area is critical in medical and clinical decision making.

Debiopharm Diagnostics Approach

At the beginning, Debiopharm Diagnostics was keen to participate in the growth of a new and innovative diagnostic company. Debiopharm Diagnostics was and still is a strong believer in Biocartis and has been unwavering in its support of the company and its operations.

The IPO – a new start

It is fabulous to see where the company is now. We are proud of the management and operating teams. This success enables us to invest in new business models and new companies such as GenePOC, a 2nd-generation low-cost Point of Care platform, targeting infectious diseases.

While Debiopharm is making great efforts to include accurate and up-to-date information, we make no representations or warranties, express or implied, as to the accuracy or completeness of the information provided in this document and disclaim any liability for the use of it. Neither Debiopharm nor any other party involved in creating, producing or delivering this document shall be liable in any manner whatsoever for any direct, incidental, consequential, indirect or punitive damages arising out of your access, use or inability to use this document, or any errors or omissions in the content thereof.